The Ultimate Guide to Importing Hardware & Industrial Goods from China to the Philippines

Author: A Senior International Trade Consultant with 10+ Years of Asia-Pacific Experience

Introduction: Tired of Paying Middlemen’s Markups?

Imagine being able to source high-quality hardware tools, construction materials, or industrial components directly from Chinese manufacturers. The potential for higher profit margins and a competitive edge is enormous. Yet, for many Filipino SMEs, the process of importing seems shrouded in complexity—customs clearance, daunting paperwork, and unpredictable costs.

Here’s the truth: Importing directly is a manageable process once you understand the roadmap. This guide is designed to be your roadmap, transforming you from an import novice into a confident importer who can cut costs and control your supply chain.

Why does the import process feel so complex, and how can you simplify it? Let’s start with the big picture.

Mapping Your Import Journey: From Factory Floor to Your Door

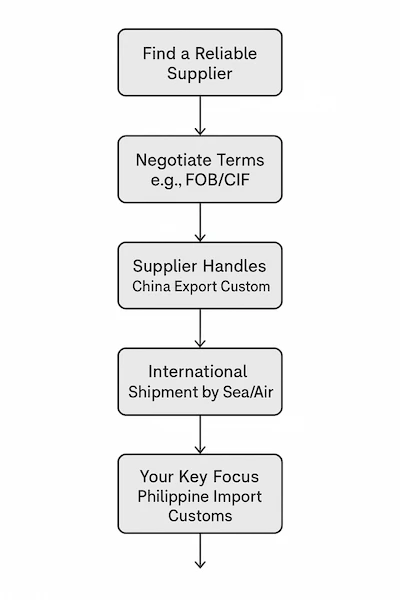

Think of your first import shipment as a journey. You need a reliable map to know what to expect at each stage. The entire process can be broken down into a clear sequence of events, most of which are handled by professionals you hire.

As you can see, your primary focus begins once the goods are on the water. But how do you ensure the shipment clears Philippine customs smoothly once it arrives? The answer lies not in memorizing regulations, but in mastering one critical thing: the paperwork.

The Key to a Smooth Customs Clearance: Getting Your Documents Right

In the world of international trade, documents are everything. They are your shipment’s passport, insurance policy, and tax declaration all in one. A single missing or incorrect document can lead to weeks of delays and hefty storage fees. So, what’s absolutely essential?

Let’s break down the critical documents you must have:

- Commercial Invoice: This is the “price tag” for customs. It must accurately and honestly describe the goods, quantities, and the actual value you paid. Why is accuracy here so critical? Because this is the primary document customs uses to assess your duties and taxes. Inconsistencies are a major red flag that trigger inspections.

- Packing List: Think of this as the detailed contents list of every single box or container. It details weights, dimensions, and exactly what is inside each package. This is crucial for your freight forwarder to handle logistics and for customs during any physical examination.

- Bill of Lading (B/L): This is the title document to the goods. It’s a receipt from the shipping company and a legal document that proves ownership. You’ll need to discuss with your forwarder whether an Original or Telex Release B/L is best for your situation.

- Certificate of Origin (Form E): This is Your Secret Weapon for Saving Money.

- Why is the Form E so important? Under the ASEAN-China Free Trade Agreement, presenting a valid Form E allows you to claim preferential tariff rates, which can reduce your import duty to 0% for many hardware and industrial items. This isn’t a small discount; it’s a massive competitive advantage.

- How do you get it? Your Chinese supplier is responsible for applying for it through their local authorities. The crucial step for you is to confirm, before you pay, that your supplier can and will provide a valid Form E.

Recommended Resource: For the most current list of products eligible for tariff concessions, always check the official Philippine Bureau of Customs Website.

Beyond the Invoice: Understanding the Real Cost of Importing

So, you’ve paid your supplier and have all your documents ready. But how much will you actually need to pay to get your goods out of the port? This is where many new importers get a nasty surprise. Let’s demystify the costs you’ll face in the Philippines.

Your main costs at customs are:

- Customs Duty: Calculated as a percentage of the CIF Value (Cost of Goods + Insurance + Freight). This is the cost that your Form E directly targets and reduces.

- Value-Added Tax (VAT): Currently 12% in the Philippines. It’s important to know that VAT is not just applied to the CIF value. It’s calculated on the Dutiable Value, which is (CIF Value + Customs Duty + Other Charges).

To visualize how these costs add up to your total “Landed Cost,” see the breakdown below:

| Cost Component | Who Charges It? | Why It’s Important |

|---|---|---|

| Product Cost | Chinese Supplier | The base price. Negotiate wisely. |

| Shipping & Insurance | Freight Forwarder | Varies greatly by volume and Incoterm. |

| Customs Duty | Bureau of Customs | Can be minimized with Form E. |

| 12% VAT | Bureau of Customs | Calculated on (CIF + Duty + other fees). |

| Brokerage Fees | Your Customs Broker | Their professional service fee. |

Learning from the Pros: How to Avoid Costly First-Time Mistakes

Now that you understand the process and the costs, how can you make sure your first import experience is a success and not a headache? The best way is to learn from the common mistakes others have made.

- Your Most Important Partner: A Reputable Customs Broker. Don’t see this as an extra cost; see it as hiring a local guide. A good broker knows the intricacies of the Bureau of Customs and will save you time, money, and stress. Ask for recommendations from other business owners in your industry.

- The #1 Mistake to Avoid: Undervaluing Your Shipment. Declaring a lower value on the commercial invoice to save on duties is extremely tempting but incredibly high-risk. Customs authorities have sophisticated methods to check world prices. The penalties—including heavy fines, seizure of goods, and being blacklisted—are far worse than paying the correct duty.

- Communication is Key: Be Specific with Your Supplier. Don’t assume your supplier knows Philippine requirements. Be explicit: “For this shipment to the Philippines, we require a commercial invoice, packing list, and a valid Form E certificate.”

- Start Small, Think Big: Use a Trial Shipment. Before you fill a full container, test the waters. Place a smaller order that can be shipped via LCL (Less than Container Load) or air freight. This allows you to test the product quality, the supplier’s reliability, and the import process with lower risk.

Where can you find reliable partners? Check established platforms like Shiply Philippines or local business directories to find and compare freight forwarders and brokers.

Conclusion: Turning Import Knowledge into Competitive Advantage

Importing directly from China is the most powerful strategy for Filipino hardware and industrial businesses to grow and stay competitive. While the process involves several steps, it is a learnable and manageable skill.

Remember, your success hinges on three pillars: a reliable supplier, impeccable paperwork (with Form E as your star player), and a trusted Philippine customs broker.

Stop letting the fear of complexity hold your business back. Use this guide to ask the right questions, make informed decisions, and turn importing into your most powerful tool for growth.

Ready to take the next step? Begin by researching and shortlisting experienced customs brokers in your area today.

About the Author

Vincent D.

Foreign Trade Manager

China Dingya Metal Manufacturing Co., Ltd.

With over a decade of experience as a senior international trade consultant specializing in the Asia-Pacific market, I have helped hundreds of SMEs in the Philippines, Thailand, and Vietnam build efficient and cost-effective supply chains for hardware and industrial components.

Let’s Connect:

- WhatsApp: +86 138 XXXX XXXX

- Email: v.ding@dingyametal.com

- Website: www.dingyametal.com

- Facebook: Dingya Metal Manufacturing